The Storm

A Perfect Storm has landed in the financial service industry and will have a detrimental impact on policyholders. The impact will be long term and largely unnoticed by the financial press. The persistent low interest rate environment is devastating life insurance policies purchased over the past 25 years. Cash value polices, sometimes referred to as permanent insurance, have an interest/investment component applied to the cash value build up within the policy. Interest rates are at historic lows and remain low for an extended period. The result is lower crediting rates being applied to the policy cash value. It is not uncommon to see a policy written in the 1980’s with a projected rate of 8% having received a 3% or 4% crediting rate for the past five years and for the foreseeable future. This has a direct impact on the premium funding required to maintain the policy in force to age 95 or 100. In one recent case the policy was originally funded at $15,000.00 a year for $1,000,000 death benefit. The premium required now to maintain the death benefit to age 100 is $34,000.00.

From Bad to Worse

Low interest rates are also impacting the profitability of the life insurance companies. Traditionally the industry invested in bonds and mortgages. As the yield on bonds has remained low, companies have taken two tacks. Some companies have varied from the traditional bonds and mortgages by adding alternative investments such as commodities and private investments. In addition over the past 18 months, several major life insurance carriers have elected to increase the internal Cost of Insurance or “COIs” on in force policies. At last count, the number of major life insurance companies that have increased COIs was 13. This occurs on all policies in a specific class, not by individual insured.

The companies have always had the legal contractual right to increase Cost of Insurance charges. Historically, it has not been a practice of the industry. This had captured the attention of some state regulators, as reported in the Wall Street Journal article, Friday, November 18, 2016. “Life Insurers Face Heat in New York.” According to the WSJ article, tens of thousands of policyholders have been hit with higher charges in their polices, ranging from single digit percentages to more than 200%. The article indicates Insurers’ portfolios are yielding 5%, down from 10% in the middle 1980’s.

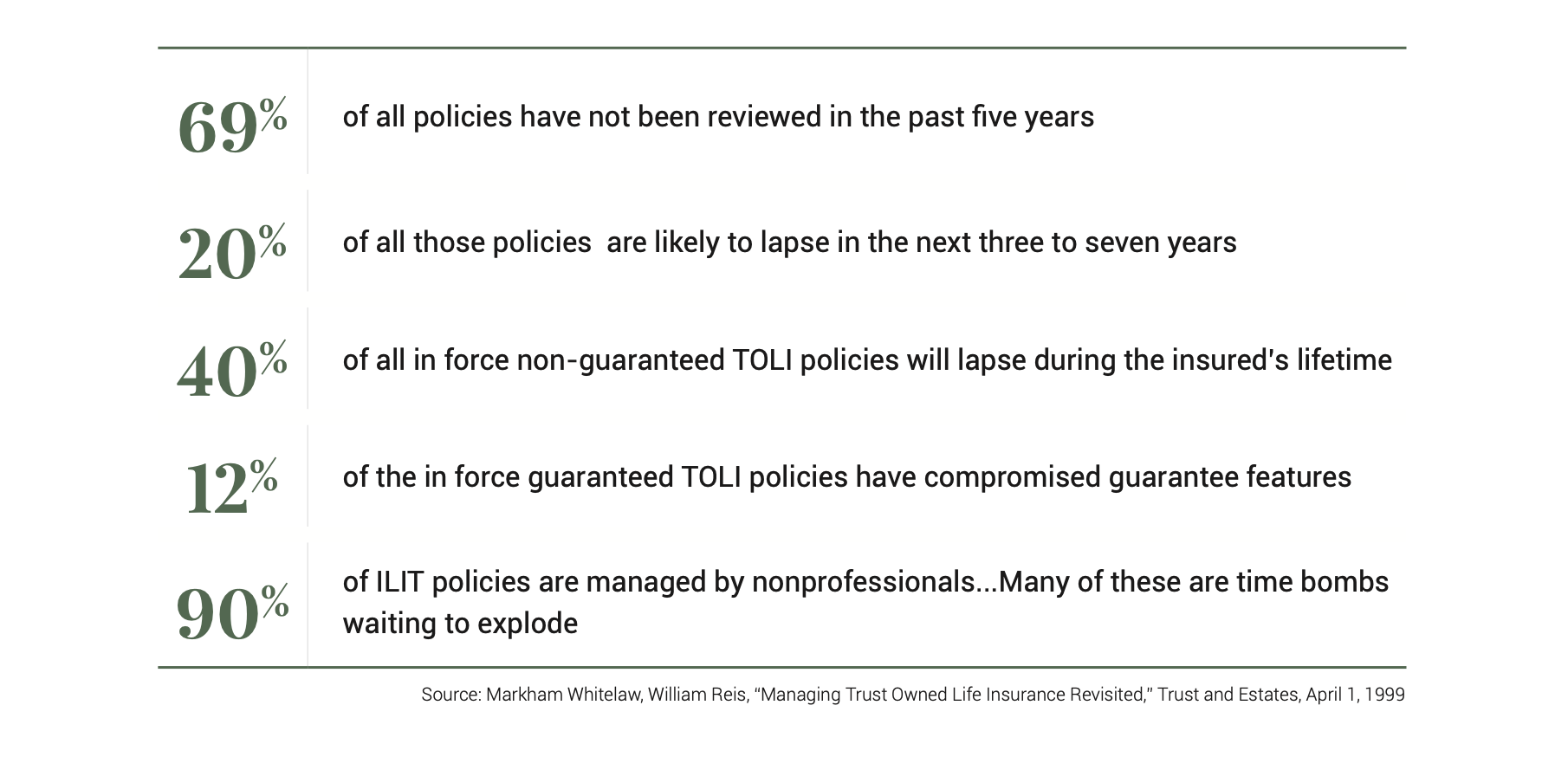

In the recent book, The Life Insurance Policy Crisis, authors E. Randolph Whitelaw and Henry Montag state, “It is estimated that approximately 25% of in force flexible premium TOLI (Trust Owned Life Insurance) are projected to lapse during the insured’s lifetime.” They provide that based on 2008 data, 1.1 million policies lapsed with a face value of $112 Billion. In 2013, according to an article, by Martin Shenkmen, CPA, JD, AEP, the lapse rate was 5.7 percent; 82 percent of these lapses generated no value to the policyholder.